AWRS Penalties

Are you aware of the penalties that HMRC can apply for non-compliance with Excise Notice 2002: Alcohol Wholesaler Registration Scheme. Please see below some of the issues now faced by businesses selling duty paid alcohol within the UK, and the possible penalties for not meeting your legal obligations.

AWRS contraventions and penalties

As you know HMRC will penalise those who trade with other companies that should be registered under the AWRS but aren't, the maximum penalty is £10,000.00 per contravention. If a company is liable for a penalty they start with the maximum amount and it decreases as per the circumstances and help / assistance given.

Fines will be in writing and a breakdown will be given as to how it’s been worked out. Penalties can be reviewed or appealed against.

HMRC will penalise:

- If a company commits a contravention

- If a company asks an employee / advisor to do something on their behalf, the company must do as much as they can to make sure they don’t commit a contravention, if they do the company is liable

HMRC won’t penalise:

- If a company has a reasonable excuse and complied in full with the AWRS requirements without unreasonable delay

Reasonable excuses are:

- Something that stopped them from meeting a tax obligation on time, which they took reasonable care to meeting

- Circumstances beyond their control or a combination or events – once this excuse has ended then there must be no delay in rectifying it

- What is a reasonable excuse for one person may not be a reasonable excuse for another

HMRC will be lenient and reduce penalties:

HMRC will reduce the amount of any penalty the charge depending on their view of how much assistance has been given. By assistance they mean

- ‘quality of disclosure’

- Unprompted disclosure: If HMRC is informed about a contravention before the company had any reason to believe that HMRC were about to find it

- Prompted disclosure: If HMRC are informed at any other time

- The penalty for an unprompted discloser is lower than the prompted

- Telling (up to 30% penalty reduction) or giving HMRC help (up to 40% penalty reduction) i.e.:

- agreeing that there has been a contravention and the reasons why and how

- answering all questions in full

- responding to HMRC’s letters

- attending meetings/visits

- Allowing access to records and other documents, without delay (up to 30% penalty reduction)

If:

- there are special circumstances that HMRC can take in to consideration when working out the penalty, let them know immediately

- assistance is forthcoming the penalty would be reduced a little more than if not

- extra assistance is not required then HMRC will give the company the highest reduction possible

Company Officer

A company officer may have to pay some or all of the company’s penalty if the penalty is due to their actions and one or more of the following applies:

- They have gained, or attempted to gain, personally from a deliberate contravention

- The company is, or believed to become insolvent, even if the officer didn’t gain personally from the deliberate contravention

If the company pays the penalty, HMRC will not ask the officer(s) to pay

Penalties

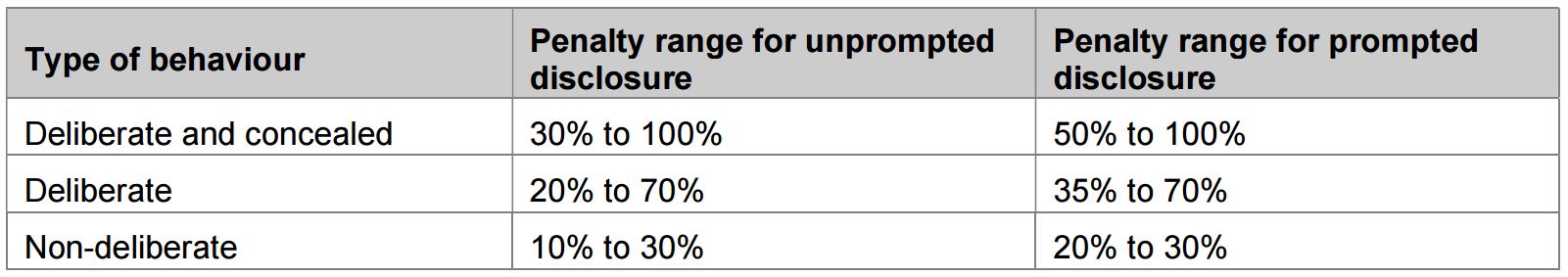

When working out penalties HMRC refer to the behaviour involved:

- Non-deliberate

- Deliberate but not concealed

- Deliberate and concealed

The type of behaviour alongside the type of disclosure is how the penalty amount is worked out:

![[CODE]](http://thedde.com/wp-content/themes/dde-theme-angled-crown/img/footer-logo.png)